“How This $19 Card Saved Me And My Family From Touchless Pickpockets”

It was Wednesday morning 3 weeks ago. My card kept getting declined. Then, on my way to lunch at work, I checked my account.

No money inside — just a few cents left in both my checking and saving.

I’m not a rich man. I live paycheck to paycheck like all wage slaves do. But I had about $2000 in my bank account and they took everything.

And here’s the kicker — my card never left my person. The thieves never got to see it or handle it. But I figured out how they did it.

“They took everything…”

It happens in a crowd

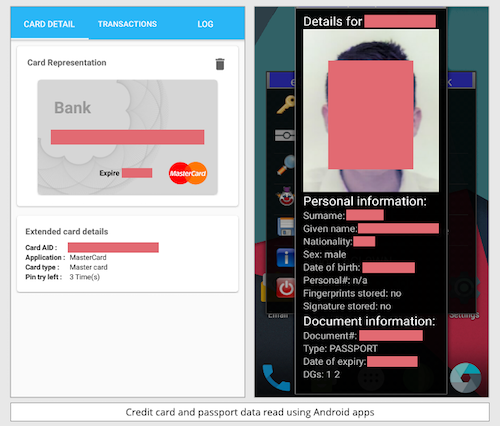

The pickpockets just need to get close to you to wirelessly steal your information

$500 dining spree

One woman got a new card directly from her bank branch — the card was never in the mail. She carried it around in her bag for a few days and she never once paid with it. And then somehow, somebody swiped the information from her card.

They counterfeited her chip card, and went on a $500 dining spree to McDonald’s, KFC, Starbucks, Burger King, Subway, etc.

Zero liability… yeah, right

Simple solution

Digital theft: It can happen to anyone

Not created equal

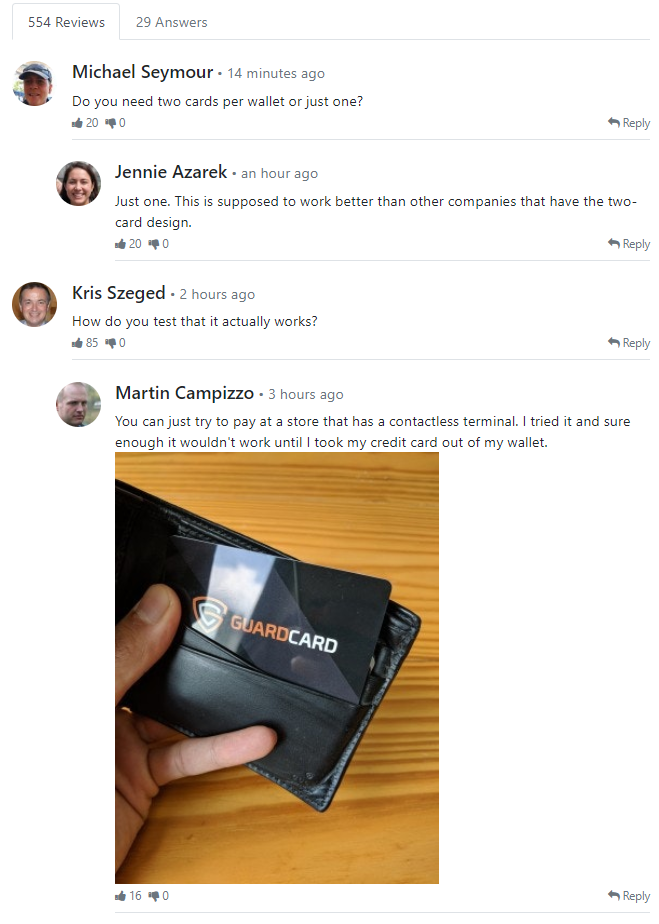

There are a bunch of sellers online (including on Amazon) selling various credit card protectors. It turns out most of them are little more than strips of aluminum foil. They are cheap and chances are good they don’t actually do anything.

I asked my son Chris, who works in IT, to figure out which of these I should buy. He did his research and recommended a brand called GuardCard because it actually jams the signal that pickpockets use to steal from you. He ordered one for me, and then he showed me why this brand works better than other credit card protectors.

So easy to get ripped off

But then he put the GuardCard protector into my wallet. And he tried scanning the wallet again with his phone. He showed me the app. There was nothing there, because the GuardCard blocked the app from reading my information. I was finally safe from digital pickpockets — as well as anybody else who might be scanning me.

Stop being tracked

So this card protector definitely works against pickpockets. And that’s not the only reason why I want to use it. It’s also good against everybody who’s tracking you these days — the government, banks, and stores.

For example, my wife went shopping recently with a friend. She walked into a store looking to buy bed sheets — but she didn’t get anything. When she got home, she noticed all sorts of ads on her Facebook profile for bed sheets.

I don’t know how this happens. But I think it’s possible these stores are tracking you thanks to your bank card, and then passing that information to Facebook. Which brings me to my final point.

Why run the risk?

Walking Around Without A GuardCard Is Like Leaving Money For Thieves Hanging Out Of Your Back Pocket

Getting your card information skimmed can cost you thousands of dollars, and weeks or months of hassle. After it happened to me, I knew it would be foolish of me not to protect myself against this nightmare.

And it’s so easy to do. That’s why I’ve now use this credit card protectors for myself, and why I encourage you to do the same.

Over 120,000 Sold: GuardCard Official Review

Security specialists agree the GuardCard is a must have in the modern world of digital scanners and hackers. Since launching earlier last year, it has become so popular that the company has already sold 120,000 units and is now on the verge of selling out. To get one while they’re still available, I decided to make the purchase and check it out:

40% off for the moment

I just found out that the GuardCard company is running a 40% off sale right now. Even though I already have their credit card protector, I’ll take advantage of this to buy a few more to give out to friends and family. If you want your cards to be safe against contactless theft and fraud, then check out these bank card protectors while the current discount still lasts.

How To Eliminate Credit Card Theft Now

Now that you’ve been informed of this revolutionary theft protection device, let me show you how easy it is to use it. All you need to do is follow these 3 steps:

- Step 1: Order your GuardCard™ today to take advantage of the 40% off discount.

- Step 2: After receiving the product, take it out of the package and put into a card holder in your wallet.

- Step 3: Walk around with peace of mind knowing your credit card information is safe from thieves!

Here’s a tip: Know anyone who needs to protect their credit card information? This device makes for the perfect gift and will save whoever receives them a lot of money, time and frustration.

Customer Ratings

4.9 average based on 554 reviews

Hi, I’m Dave. I work at a financial technology firm in New York and write about all things related to technology, security, and finance in my spare time. When I’m not working or blogging, you can find me jogging around Central Park.

– Dave Bronson

THIS IS AN ADVERTISEMENT AND NOT AN ACTUAL NEWS ARTICLE, BLOG, OR CONSUMER PROTECTION UPDATE

MARKETING DISCLOSURE: This website is a market place. As such you should know that the owner has a monetary connection to the product and services advertised on the site. The owner receives payment whenever a qualified lead is referred but that is the extent of it.

ADVERTISING DISCLOSURE: This website and the products & services referred to on the site are advertising marketplaces. This website is an advertisement and not a news publication. Any photographs of persons used on this site are models. The owner of this site and of the products and services referred to on this site only provides a service where consumers can obtain and compare.

© 2019 All Rights Reserved. Privacy Policy Terms of Use